Breaking Down the Cost of Hiring an Estate Planning Lawyer

DIY Planning an Estate vs. Hiring an attorney

You shouldn’t rely on the internet for everything, although it can be helpful for quick repairs and advice. You’re better off engaging an expert when it comes to something as significant as estate planning. Online advertisements for do-it-yourself kits highlight their affordability and ease of use. Someone without heirs or a sizable estate might find it appealing, but not if you have any unique requirements.

Estate Planning Fee Types

You could get different estimates from different estate lawyers because they don’t all use the same pricing structure. It’s crucial to understand who is handling the task, what kind of plan you require, and the preferred legal fees of your estate planning lawyer when attempting to budget for the Cost of estate planning lawyer.

Rate per Hour

Your lawyer will probably utilize an hourly rate if they are unable to determine a set cost to charge you. This would include any time spent on your case by your attorney. Your lawyer may also ask for a retainer up front before they start, even if they are charging by the hour. This might be all of it or just some of it. If the latter, the remaining amount will be billed to you later.

If your lawyer thinks the details of your estate plan will take more time or effort, an hourly rate can be used. Based on their expertise and experience, they can also have a regular hourly rate.

One-time Charge

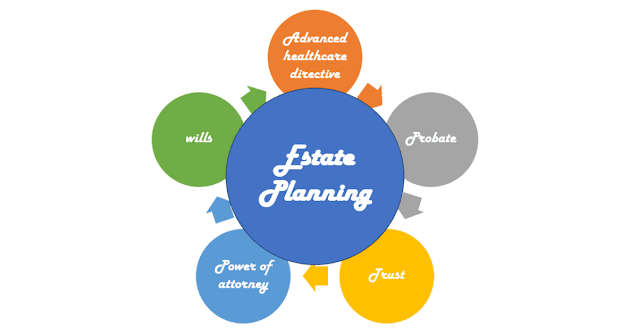

A flat fee is a set amount that your lawyer could charge to cover their estate planning services and expertise. Usually, this cost includes creating the required paperwork, like a power of attorney or will. You should find out what is covered by the plan if your lawyer requests a fixed price. This is because it is subject to modification at the discretion of the estate planner. For instance, certain lawyers would not assist with trusts or provide a notary.

Before they start working, your lawyer might also ask you to pay a flat fee in full or in part. Therefore, it is important to inquire in advance about the expected payment schedule and the scope of a flat charge.

The contingency fee

In circumstances where you will be compensated financially, a contingency fee is utilized. For instance, you pay your lawyer a portion of the money you receive after winning a case. For this reason, contingency fees are not commonly used by estate planners. Without a counterargument, they are illogical. However, a probate lawyer may use this kind of charge if you need to settle an estate.

These expenses don’t account for any potential expenses your estate might incur if you don’t adequately plan for retirement and beyond.

Factors that May Make Your Bill Higher

Why Do Prices Differ Based on Estate Plan?

How to Reduce the Cost of Estate Planning

The process of estate planning can be expensive and uncertain. You can be paying an unforeseen large cost, depending on your circumstances. However, there are ways to assist reduce the expenses if you prepare appropriately. Here are some ideas for you to think about:

- Select the appropriate lawyer: Look up companies, read reviews, and contrast them. Make an effort to arrange a face-to-face consultation with each of them.

- Make a plan: Be well-prepared for your first meeting. Find out what a basic estate plan entails and if further documents are required.

- Talk about money up front: In-person or over the phone, a firm may provide a free initial consultation. Take advantage of the chance to talk about prices and the potential length of the process.

- Put it all in writing: After selecting your lawyer, be careful to create a written contract that you both sign. It should cover all expenses and the job your lawyer will accomplish.

The Value of Making an Estate Plan

It also enables you to take crucial precautions for your kids. You can protect their welfare and lessen their financial burden by designating a reliable guardian. Without careful planning, taxes and legal fees might drastically cut their inheritance, leaving them with much less than they had hoped expected.

The bottom line

Advice for planning your estate

- The distribution of your assets may be delayed for up to a year due to the probate process. You can assist your heirs in avoiding this inconvenience, though, with careful estate planning. You may manage your wealth and arrange your estate with the assistance of a qualified financial counselor. With the help of SmartAsset’s free service, you can find local financial advisors and conduct free interviews with them to determine which one is best for you. Get started right now if you’re prepared to locate an advisor who can assist you in reaching your financial objectives.

- There are other trusts that can assist you protect your assets from probate besides a revocable living trust. To determine which type of trust is best for you, research how various trusts operate.

Wow plenty of wonderful data!

Seriously loads of great information.

Good forum posts, Thank you.

You expressed it superbly.

You said it perfectly.!

Incredible tons of superb knowledge!

You reported it terrifically!

Information effectively taken.!

Valuable stuff Many thanks.

You said this exceptionally well!