When it comes to purchasing a home, most people encounter the term “mortgage” early in their journey. But what exactly is a mortgage, and how does it work? Understanding the definition of mortgage is crucial for anyone considering homeownership or looking to refinance their existing property. This comprehensive guide will break down everything you need to know about mortgages in clear, simple terms.

What is a Mortgage? The Basic Definition

The definition of mortgage is straightforward: it’s a loan specifically designed to help you purchase real estate, typically a home. In this financial arrangement, the property itself serves as collateral for the loan. This means that if you fail to make your mortgage payments, the lender has the legal right to foreclose on the property and sell it to recover their money.

A mortgage consists of two main components: the principal (the amount you borrow) and interest (the cost of borrowing that money). When you make monthly mortgage payments, you’re paying back both the principal and interest over a predetermined period, usually 15 to 30 years.

Key Components of a Mortgage

Principal and Interest

The principal is the original loan amount, while interest is the fee charged by the lender for borrowing money. Early in your mortgage term, a larger portion of your payment goes toward interest. As time progresses, more of your payment applies to the principal balance.

Property Taxes

Most mortgage payments include property taxes, which are collected by your lender and held in an escrow account. The lender then pays these taxes to your local government on your behalf when they’re due.

Homeowners Insurance

Lenders require homeowners insurance to protect their investment. Like property taxes, insurance premiums are often collected with your mortgage payment and paid from an escrow account.

Private Mortgage Insurance (PMI)

If you make a down payment of less than 20%, you’ll likely need to pay PMI. This insurance protects the lender if you default on your loan and is typically removed once you’ve built up 20% equity in your home.

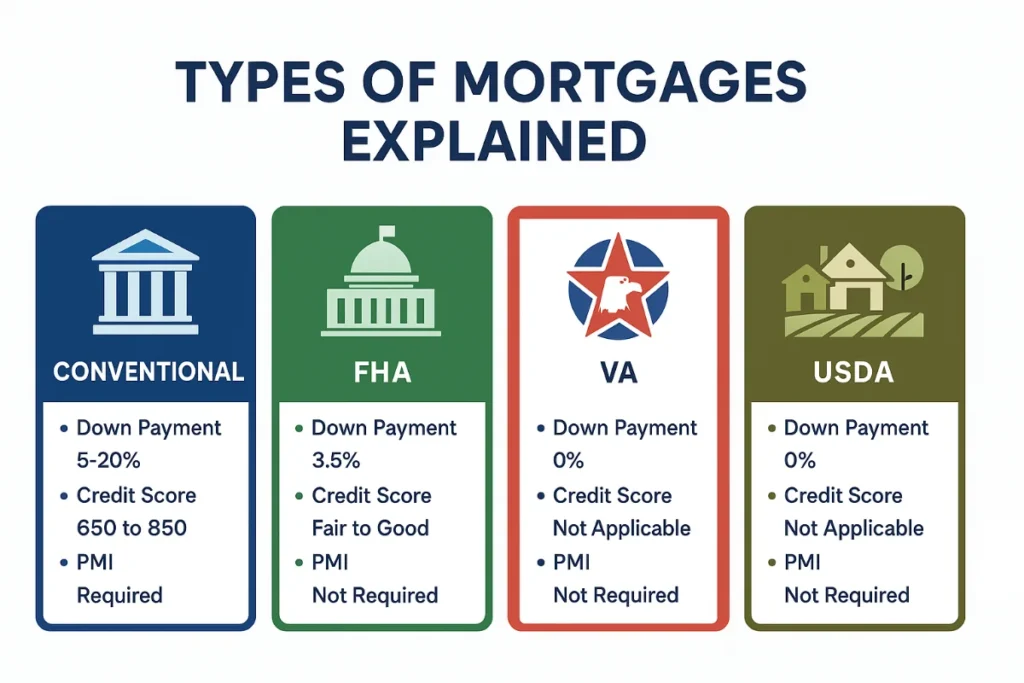

Types of Mortgages Explained

Understanding the definition of mortgage also means knowing the different types available:

Conventional Mortgages

These are traditional loans not backed by government agencies. They typically require higher credit scores and down payments but often offer competitive interest rates for qualified borrowers.

FHA Loans

Backed by the Federal Housing Administration, FHA loans allow lower down payments (as little as 3.5%) and are more accessible to borrowers with lower credit scores.

VA Loans

Available to eligible veterans and service members, VA loans often require no down payment and don’t require PMI, making them an excellent option for those who qualify.

USDA Loans

Designed for rural and suburban homebuyers, USDA loans can offer 100% financing for eligible properties in designated areas.

How Mortgages Work: The Process

The mortgage process begins with pre-approval, where lenders evaluate your financial situation to determine how much they’re willing to lend. This involves reviewing your credit score, income, debt-to-income ratio, and available funds for a down payment.

Once you find a home and make an offer, you’ll complete a formal mortgage application. The lender will order an appraisal to ensure the property’s value supports the loan amount. After underwriting approval, you’ll proceed to closing, where you’ll sign the final documents and receive the keys to your new home.

Factors Affecting Your Mortgage

Several factors influence your mortgage terms and rates:

Credit Score: Higher scores typically result in better interest rates and loan terms. Most lenders prefer scores of 620 or higher for conventional loans.

Down Payment: Larger down payments reduce your loan amount and may eliminate the need for PMI. They also demonstrate financial stability to lenders.

Debt-to-Income Ratio: Lenders prefer that your total monthly debt payments don’t exceed 43% of your gross monthly income.

Employment History: Stable employment demonstrates your ability to make consistent mortgage payments.

Benefits and Risks of Mortgages

Benefits

Mortgages make homeownership accessible by allowing you to purchase property without paying the full price upfront. They also offer potential tax benefits, as mortgage interest may be tax-deductible. Additionally, as you pay down your mortgage, you build equity in your home.

Risks

The primary risk is foreclosure if you can’t make payments. Mortgages also represent long-term financial commitments, and interest payments can add significantly to the total cost of your home over time.

Tips for Getting the Best Mortgage

To secure the best mortgage terms, maintain a good credit score by paying bills on time and keeping credit card balances low. Save for a substantial down payment, shop around with multiple lenders to compare rates and terms, and consider getting pre-approved before house hunting to strengthen your offers.

Conclusion

Understanding the definition of mortgage is the first step toward successful homeownership. A mortgage is more than just a loan; it’s a financial tool that can help you achieve your dream of owning property while building long-term wealth through equity. By familiarizing yourself with mortgage types, terms, and the application process, you’ll be better prepared to make informed decisions and secure the best possible loan for your situation.